Published on 2025-06-26T05:09:54Z

What is Accrual Accounting in Analytics? Examples & Importance

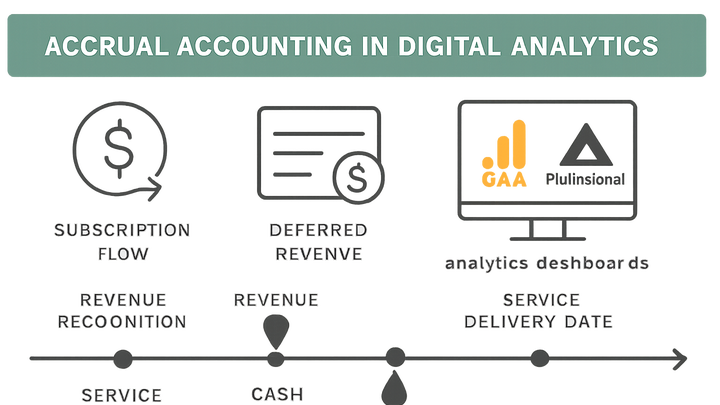

Accrual accounting is an accounting method that recognizes revenues and expenses when they are earned or incurred, rather than when cash changes hands. In the context of analytics, accrual accounting ensures that metrics like Monthly Recurring Revenue (MRR), Customer Lifetime Value (CLV), and deferred revenue align with the actual delivery of services rather than payment timings. This approach is critical for subscription-based businesses and SaaS platforms, where cash receipts often lag or lead service usage. By integrating accrual principles into analytics workflows—using tools like PlainSignal and Google Analytics 4—teams can generate reports that accurately reflect business performance, streamline forecasting, and maintain compliance with accounting standards such as GAAP or IFRS. Understanding accrual accounting empowers analysts to differentiate between earned and unearned revenue, reconcile financial and behavioral data, and make data-driven decisions based on true operational metrics.

Accrual accounting

Accrual accounting recognizes revenues and expenses when earned or incurred, enabling analytics teams to report accurate subscription and deferred revenue metrics.

Understanding Accrual Accounting

Accrual accounting is a method that recognizes revenue and expenses when they are earned or incurred, rather than when cash is exchanged. In analytics, this ensures metrics reflect actual service delivery and align with financial reporting periods. This approach is vital for subscription-based or deferred payment models where cash flows lag or lead usage. Incorporating accrual principles into analytics dashboards delivers clearer performance insights, more reliable forecasts, and helps maintain compliance with GAAP or IFRS.

-

Key principles

Accrual accounting rests on two fundamental principles that ensure financial events align with business activities more accurately.

-

Revenue recognition principle

Record revenue when it is earned, not when cash is received. For analytics, attribute subscription revenue to the period the service was delivered.

-

Matching principle

Match expenses to the revenues they help generate to ensure analytics reflect true profitability for each period.

-

-

Accrual vs cash accounting

Contrasting accrual with cash accounting highlights why accrual provides a more comprehensive view of financial performance.

-

Timing of transactions

Cash accounting logs transactions when cash moves, which can misalign revenue with the delivery of services.

-

Financial insights

Accrual accounting provides a more accurate view of performance metrics, essential for subscription businesses and long-term forecasting.

-

Importance in Analytics

For analytics teams, adopting accrual accounting leads to more accurate reporting, better forecasting, and a stronger alignment between user behavior and financial outcomes.

-

Accurate revenue metrics

By recognizing revenue when services are delivered, analytics platforms can calculate metrics like Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR) that truly reflect business health.

-

Deferred and prepaid revenue tracking

Analytics can capture deferred revenue liabilities—cash received upfront for future services—ensuring dashboards differentiate earned from unearned revenue.

Implementing Accrual Accounting in SaaS Analytics

Use analytics tools to capture event data that supports accrual-based reporting. This involves tagging events for subscription starts, renewals, and service usage, and mapping them to financial metrics.

-

PlainSignal implementation

PlainSignal offers cookie-free event tracking, making it straightforward to capture revenue events without privacy trade-offs.

-

Setup tracking code

Insert the PlainSignal snippet into your header to start capturing events. Example:

<link rel="preconnect" href="//eu.plainsignal.com/" crossorigin /> <script defer data-do="yourwebsitedomain.com" data-id="0GQV1xmtzQQ" data-api="//eu.plainsignal.com" src="//cdn.plainsignal.com/plainsignal-min.js"></script> -

Tagging revenue events

Define custom events such as

subscription_startandsubscription_renewalwith a revenue parameter to feed accrual reports.

-

-

GA4 configuration

Google Analytics 4 uses an event-based model that can record revenue when the service period begins, aligning with accrual principles.

-

Install GA4 snippet

Add the GA4 gtag snippet to your site header. Example:

<!-- Global site tag (gtag.js) - Google Analytics --> <script async src="https://www.googletagmanager.com/gtag/js?id=G-XXXXXXXXXX"></script> <script> window.dataLayer = window.dataLayer || []; function gtag(){dataLayer.push(arguments);}gtag('js', new Date()); gtag('config', 'G-XXXXXXXXXX'); </script> -

Define e-commerce events

Use GA4 e-commerce events like

purchasewithvalueandcurrencyparameters when the service period starts to capture earned revenue accurately.

-

Common Challenges and Best Practices

Implementing accrual accounting in analytics can lead to data discrepancies and configuration errors. Address these proactively with clear standards and regular audits.

-

Reconciliation challenges

Discrepancies between analytics and accounting records often stem from missed events or mismatched timestamps.

-

Event configuration mistakes

Incorrectly defined events or parameters can cause over- or under-reporting of revenue in analytics dashboards.

-

Best practices

Regularly audit your event data, maintain consistent naming conventions, and ensure analytics definitions align with financial policies to minimize errors.

-

Consistent naming conventions

Use clear, uniform event names and parameter keys across platforms to avoid confusion and simplify reporting.

-

Periodic data audits

Compare analytics revenue events with accounting reports monthly to identify and correct discrepancies early.

-