Published on 2025-06-27T20:16:46Z

What is Payback Period? Examples in Analytics

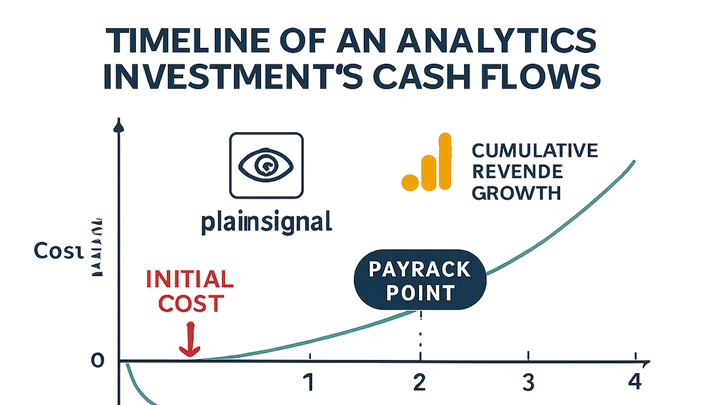

Payback Period is a financial metric that indicates the time required for an investment to generate cash flows sufficient to recover its initial cost.

In the analytics industry, this metric helps businesses understand how quickly their spending on analytics tools, campaigns, or processes translates into measurable returns.

The payback period focuses solely on the time dimension, offering a simple gauge of investment recoupment without delving into profitability beyond breakeven.

While it doesn’t account for the time value of money or returns after the payback threshold, it’s widely used for its straightforward calculation and clear benchmark.

By combining payback period analysis with other metrics like ROI and Customer Lifetime Value (LTV), analysts can make well-rounded decisions on budget allocation and strategy prioritization.

Payback period

Time needed to recover an analytics investment's cost via generated revenue or savings.

Understanding Payback Period

The Payback Period is the time it takes for an investment to generate enough cash flows to recover its initial cost. In analytics, it measures how quickly spending on tools or campaigns is recouped through generated revenue or savings.

-

Definition

The Payback Period is the duration needed to break even on an investment by calculating when cumulative cash inflows equal the initial cost.

-

Key characteristics

Focuses solely on time to recoup costs, offering a simple and intuitive way to assess investment risk without evaluating profitability beyond breakeven.

Why Payback Period Matters in Analytics

Payback Period helps analytics teams evaluate the efficiency and effectiveness of investments in tracking tools, marketing campaigns, or data platforms by providing a clear timeframe for cost recovery.

-

Performance benchmark

Serves as a benchmark to compare different analytics initiatives based on how quickly they return value.

-

Budget allocation

Guides decision-making on where to allocate limited budgets by prioritizing investments with shorter payback periods.

-

Risk assessment

Highlights the risk profile of investments by indicating how long capital is tied up before returns are realized.

Calculating Payback Period

There are multiple methods to calculate payback period, ranging from simple formulas to more advanced approaches that consider variable cash flows and the time value of money.

-

Simple payback formula

Divide the initial investment by the average annual cash inflow.

Formula: Payback Period = Initial Investment / Annual Cash Inflow

-

Example calculation

If you invest \(12,000 in an analytics tool and it generates \)4,000 per year in attributable revenue, the payback period is 12,000 / 4,000 = 3 years.

-

-

Cumulative cash flow method

Sum cash flows each period and identify when cumulative cash flow equals the initial investment. Useful for variable returns.

-

Step-by-step

List cash inflows by period, calculate running total, and pinpoint the period where the total meets or exceeds the initial outlay.

-

-

Discounted payback period

Accounts for the time value of money by discounting future cash flows before summing them. Provides a more accurate reflection of value over time.

-

Key difference

Uses discounted cash flows, which can extend the payback period compared to the simple method.

-

Advantages and Limitations

While Payback Period offers clear insights into investment recovery time, it has certain advantages and drawbacks that should be considered.

-

Advantages

Easy to calculate and understand; provides a quick risk assessment; useful for short-term investments.

-

Limitations

Ignores cash flows after the payback period; does not account for the time value of money (unless discounted); may misrepresent long-term profitability.

Implementing with Analytics Tools

Track and calculate payback period using analytics platforms like PlainSignal and GA4 to measure investment returns in real time.

-

PlainSignal setup

PlainSignal is a cookie-free, privacy-focused analytics tool that captures user behavior and revenue without third-party cookies.

-

Integration code

<link rel="preconnect" href="//eu.plainsignal.com/" crossorigin /> <script defer data-do="yourwebsitedomain.com" data-id="0GQV1xmtzQQ" data-api="//eu.plainsignal.com" src="//cdn.plainsignal.com/plainsignal-min.js"></script> -

Event tracking

Configure custom events in PlainSignal to capture purchase, subscription, or signup actions as cash inflow data.

-

-

GA4 configuration

Google Analytics 4 uses an event-based model to track user interactions and revenue, making it suitable for payback period analysis.

-

Enhanced ecommerce

Enable Enhanced Ecommerce in GA4 to automatically collect transaction and revenue data.

-

Custom reports

Build custom reports to measure the time from acquisition events to revenue events, supporting payback period calculations.

-

Best Practices

Apply these best practices to get the most value from payback period analysis and ensure robust decision-making.

-

Combine with other metrics

Use payback period alongside ROI, LTV, and CAC to obtain a comprehensive view of investment performance.

-

Consider discount rates for long-term projects

For investments with cash flows over many years, apply discounted payback to account for the time value of money.