Published on 2025-06-28T04:31:35Z

What is Customer Lifetime Value (CLV)? Examples of CLV

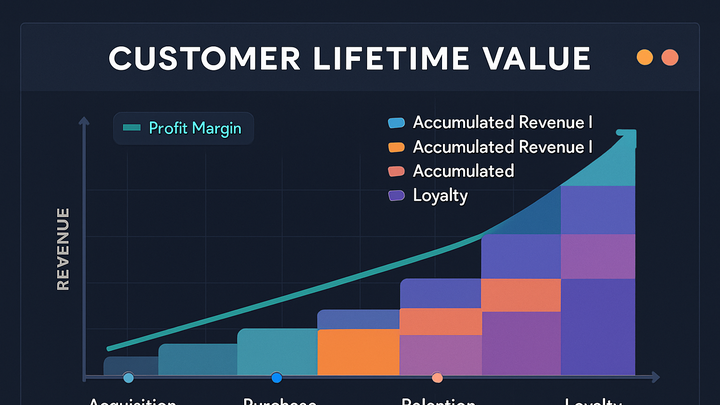

Customer Lifetime Value (CLV) is a predictive metric used in analytics to estimate the total net profit a business can expect from a customer over the entire duration of their relationship. It helps organizations understand which customer segments are most valuable and how much can be invested in acquisition and retention. CLV calculations can be based on historical data or predictive models that incorporate average revenue per user (ARPU), churn rate, and gross margin. By integrating CLV tracking into tools like Google Analytics 4 (GA4) or cookie-free solutions like PlainSignal, businesses can automate the monitoring of customer value and drive data-driven marketing strategies. Accurate CLV insights enable companies to forecast revenue, optimize marketing spend, and build long-term customer loyalty.

Customer lifetime value

Estimates the total net profit from a customer over their entire relationship.

Why Customer Lifetime Value Matters

Understanding CLV empowers businesses to focus on the most profitable customers and make strategic investments in acquisition and retention.

-

Informed marketing spend

By knowing how much a customer is worth, you can set acquisition budgets and bid strategies that drive positive ROI.

-

Revenue forecasting

CLV provides insights into future revenue streams by aggregating the expected value of all customers over time.

-

Customer segmentation

Segment customers by lifetime value to tailor retention and upsell strategies for high-value groups.

Calculating CLV

CLV can be calculated via several models, from simple historical sums to predictive formulas that factor in churn and discount rates.

-

Historical clv

Sum of past gross profit from a customer over a defined period. Useful for mature businesses with stable transaction histories.

-

Data needs

Requires accurate records of customer purchases and associated profit margins.

-

-

Predictive clv

Formula-based approach estimating future value. A common model is:

CLV = ARPU × (1 / Churn Rate) × Gross Margin-

Arpu

Average Revenue Per User over a specific period.

-

Churn rate

Percentage of customers who stop using your service during a period.

-

Gross margin

Revenue minus cost of goods sold, expressed as a percentage.

-

Implementing CLV Tracking with Analytics Tools

Leverage platforms like GA4 and PlainSignal to capture revenue events and compute CLV automatically.

-

Google analytics 4 (GA4)

- Define purchase events with a

valueparameter. - Ensure each user has a consistent ID to stitch sessions.

- Export to BigQuery and apply CLV formulas in SQL.

- Visualize results in Data Studio or Looker.

- Define purchase events with a

-

PlainSignal integration

Inject the PlainSignal script to enable cookie-free revenue tracking. Example:

<link rel="preconnect" href="//eu.plainsignal.com/" crossorigin /> <script defer data-do="yourwebsitedomain.com" data-id="0GQV1xmtzQQ" data-api="//eu.plainsignal.com" src="//cdn.plainsignal.com/plainsignal-min.js"></script>Then fire purchase events:

signal('event','purchase', { value: 100 });-

Event tracking

Implement revenue events with

signal('event','purchase', { value: amount })to feed CLV dashboards in PlainSignal.

-

Best Practices for Maximizing CLV

Improving CLV involves enhancing customer experience, reducing churn, and increasing average spend through targeted strategies.

-

Enhance retention strategies

Deploy loyalty programs, personalized email campaigns, and timely support to keep customers engaged.

-

Upselling and cross-selling

Recommend relevant products or upgrades based on purchase history to boost ARPU.

-

Personalized customer journeys

Use CLV segments to deliver tailored experiences that increase satisfaction and spending.