Published on 2025-06-22T06:50:28Z

What is CAC Payback Period? Examples and Best Practices

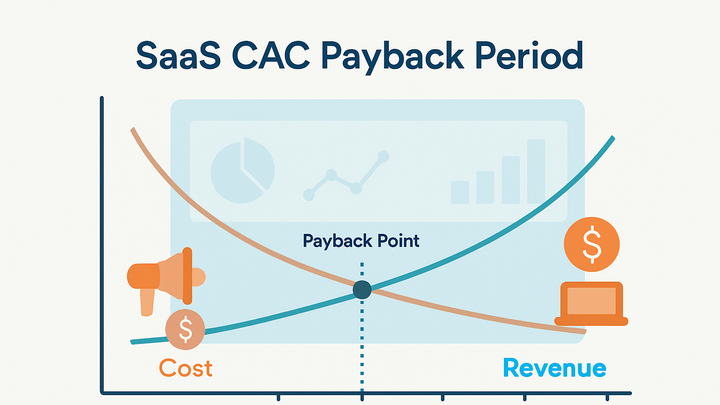

CAC Payback Period measures the time (typically in months) it takes for a SaaS company to recoup the cost of acquiring a customer through the gross margin generated by that customer.

This metric is vital in analytics-driven businesses for gauging the efficiency of marketing and sales investments.

A shorter payback period signals that new customers are quickly covering their acquisition costs, improving cash flow and enabling faster reinvestment.

Companies often benchmark payback against industry standards (e.g., 6–12 months) to ensure sustainable growth and healthy unit economics.

When analyzed alongside other key metrics like Customer Lifetime Value (CLTV) and Monthly Recurring Revenue (MRR), CAC Payback Period provides a fuller picture of long-term profitability.

By monitoring trends and segmenting by acquisition channel, teams can pinpoint inefficiencies and optimize spend.

Integrating tools like PlainSignal and GA4 for tracking events, revenue, and expenses can automate calculations and deliver real-time insights.

Cac payback period

Time required for a SaaS company to recover customer acquisition costs through monthly gross margin.

Overview of CAC Payback Period

CAC Payback Period measures the number of months required for the profit from a new customer to offset the Customer Acquisition Cost (CAC). This simple yet powerful metric captures the speed at which marketing and sales investments pay off in recurring revenue. It’s widely used in SaaS to benchmark efficiency, set growth targets, and manage cash flow. By focusing on the payback window, teams can compare channel performance and prioritize resources.

-

Definition

The CAC Payback Period is calculated by dividing total Customer Acquisition Cost by the average monthly gross margin per customer. The result indicates how many months it takes to break even on a per-customer basis.

-

Key components

Two inputs drive the formula: CAC, which sums all marketing and sales outlays per customer, and Monthly Gross Margin, which is revenue minus direct service costs. Align both metrics over the same timeframe for accuracy.

-

Formula

Payback Period = CAC / (ARPA × Gross Margin %), where ARPA is Average Revenue per Account. Expressed in months, this equation reveals the break-even point.

-

Cac

Total cost of marketing and sales divided by number of new customers acquired.

-

Arpa

Average Revenue per Account, calculated by dividing total revenue by active customer count.

-

Gross margin %

Percentage of revenue left after deducting the Cost of Goods Sold (COGS).

-

Importance in SaaS Analytics

Tracking CAC Payback Period offers actionable insights into cash flow management and growth planning. In SaaS, where upfront costs are high and revenue accrues over time, knowing payback speed guides budgeting and resource allocation. Investors and stakeholders often use this metric to assess a company’s path to profitability and capital efficiency.

-

Cash flow management

A shorter payback period reduces the time your business needs additional capital and improves working capital efficiency.

-

Growth efficiency

Comparing payback across channels helps identify the most cost-effective acquisition strategies and optimize marketing mix.

-

Investor reporting

Venture capitalists and boards evaluate this metric to understand when customer acquisition investments will start generating returns.

Calculating CAC Payback Period

The calculation involves three main steps: aggregating acquisition costs, computing average gross margin per customer, and dividing one by the other. Consistent data definitions and timeframes ensure the resulting metric is reliable and comparable over time.

-

Determine total cac

Sum all marketing and sales expenses for a given period (e.g., month, quarter) and divide by the number of new customers acquired in that same period.

-

Marketing expenses

All costs related to promotional activities, including ad spend, content creation, and agency fees.

-

Sales expenses

Costs incurred by your sales team, such as salaries, commissions, and CRM tool subscriptions.

-

-

Calculate monthly gross margin per customer

Subtract Cost of Goods Sold (COGS) from total revenue for the period, then divide by the number of customers to get average gross margin per customer.

-

Revenue

Total subscription or transaction revenue for the period.

-

Cost of goods sold (cogs)

Direct costs to deliver your service, like hosting fees and customer support.

-

-

Apply the formula

Divide the total CAC by the average monthly gross margin per customer to obtain the payback period in months. Round up to the nearest whole month for planning.

Tracking with Analytics Tools

Analytics platforms automate the collection of cost, revenue, and customer data, making CAC Payback Period tracking scalable and accurate. Below is how to get started with PlainSignal and Google Analytics 4 (GA4).

-

PlainSignal setup

Embed the PlainSignal snippet on your site to start capturing pageviews, conversions, and revenue without cookies. Then configure goals and revenue tracking in the dashboard.

-

Embed tracking code

Add the following code to your

<head>tag to initialize PlainSignal:<link rel="preconnect" href="//eu.plainsignal.com/" crossorigin /> <script defer data-do="yourwebsitedomain.com" data-id="0GQV1xmtzQQ" data-api="//eu.plainsignal.com" src="//cdn.plainsignal.com/plainsignal-min.js"></script>

-

-

GA4 configuration

In GA4, set up Purchase or Subscription events with revenue parameters. Use custom dimensions for acquisition channels and export data to BigQuery for advanced payback calculations.

-

Best practices

Filter out internal traffic, align attribution windows with sales cycles, and reconcile analytics data with CRM for accuracy.

Interpreting Results and Optimization

Use CAC Payback Period insights to refine your acquisition strategy, set financial targets, and improve unit economics. Continuous monitoring and experimentation drive sustainable growth.

-

Set benchmark targets

Define target payback windows (e.g., under 12 months) based on your business model and industry standards.

-

Optimize acquisition channels

Shift budget towards channels demonstrating shortest payback while maintaining customer quality.

-

Monitor and iterate

Review payback trends regularly, test new campaigns, and iterate to drive down costs or accelerate revenue.